Managing Small Business Cash Flow – Answers to 10 Commonly Asked Questions

Cash flow is the lifeblood of a business and critical in its growth. Small businesses are hugely dependent on their cash flow, and must either cut costs or scramble to find alternative funding when they are not being paid on time. With money tight and bank loans hard to get, a cash-strapped company can easily be pushed to the brink.

But what are the basics of good cash flow management? Are there any cash flow templates you can leverage? Where does your breakeven analysis fit in? And, what strategies can you use to ensure cash is flowing, whether you are in the startup stage or looking to grow an established business?

To find answers to these questions, I checked out an archived SBA Web Chat on – Cash Flow Management – hosted by Julie Brander a business consultant and mentor with SCORE.

Here are Julie’s answers to a series of cash flow questions posed by individual small business owners (but which are universal to us all):

Q: Would you recommend that a start-up venture in the early stages do a cash flow chart and why?

A: A cash flow is the single most important aspect of your business because it focuses on the actual cash that goes in and out of your company. Make a list of all the startup costs or one-time expenses, your monthly fixed and variable expenses, and project your sales to see if this business is feasible. Without knowing your costs and expenses, you will not be able to project your income needed to make a profit in your business.

Q: I struggle just coming up with a template to use to project out my cash flows. I use Excel, but don’t use it well. I can look at last months and know where cash went, but I want to look out to the future…one week, one month, one year. Do any tools or templates work better than others?

A: Take a look at this Cash Flow Template from SCORE for a 12-month cash flow. There are other resources online; some are free and some are not. Look into accounting software for this feature as well.

(For more specifics on what to include and why, read: Projecting your Business Cash Flow, Made Simple)

Q: If you are unable to secure credit and credit has been cut or credit lines have been closed, how do you keep the doors open to your business?

A: You will need to sell the inventory that you have and pay cash for all inventory and services that you need until you can build up your credit again. Managing your money with your cash flow chart will help so that you are aware of all expenses. Cutting expenses and increasing sales is always the goal.

Q: How important is it for start-ups to calculate their break-even point and what is the easiest way for a non-financial person to do it?

A: Create a simple spreadsheet that lists all the income from sales each day, week, month and year and all the expenses that the company has to pay out. (SBA.gov has more information on this topic here: Breakeven Analysis.) There are templates online that you can use; for example, SCORE offers a free Breakeven Chart that you can use.

Q: I have a hard time getting clients to pay on time. If they don’t pay on time, I have a hard time meeting our expenses. Any suggestions on how to get paid quicker?

A: You can offer a discount for COD (cash on delivery) or net 10 days; it could be 2% off for paying more quickly. Otherwise, the only way to get paid quicker is to call weekly and remind your customer that money is due and offer to take a charge card over the phone. (For more tips, check out this blog: How to Get Paid Faster With a Better Invoicing Process.

Q: I am in the process of opening a coffee shop. How much inventory should I purchase for startup so that I do not overbuy?

A: With your financial projections, you can guess about how much you will be selling. Buy as little as possible to start—but make sure that you can get a quick delivery, as you never ever want to run out of anything. This is something that you will learn as you are in business.

Q: Is there a set percentage to mark up the prices for merchandise? Also, if I can get a discount from a vendor for purchasing a higher volume, do I sell it at a discount or should I sell it at the price I had before the discount?

A: A mark-up can vary depending on your overhead costs. Higher overhead would require a higher mark-up. Always sell your merchandise for as much as the market will bear. If there is a higher perceived value, people will pay more. The discount from the vendor means more profit in your pocket.

Q: What options do micro businesses (mom & pop) size have in obtaining periodic help needed with small loans to help with cash flow?

A: A line of credit is the easiest way to have money available as needed. You would have a limit and use it as needed and pay only for what you use. If you are not able to get a line of credit, you need to make sure that your sales increase to create cash flow. Give your customers incentives to buy more or offer discounts.

Q: At what point should you consider using a collection agency to help you collect on past due receivables?

A: Collection agencies take 30%, so try to collect on your own by calling and offering credit terms or returns or credit card payment. If the company does not have the money, you will not be getting paid so your only hope is to take back the merchandise if you can.

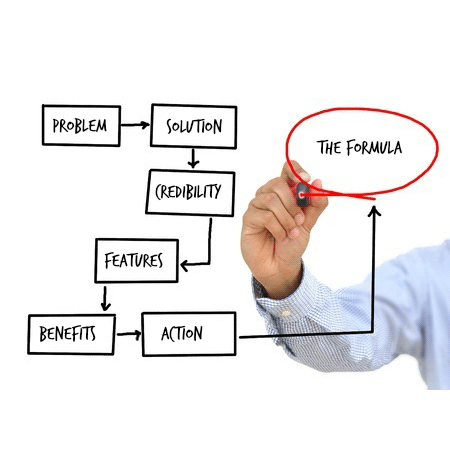

Q: What is the formula to determine how much cash reserves a business should hold?

A: Always have enough cash reserves to cover your slow months in business. You should be safe if you can have 3-6 months or more to cover all unknown or variable expenses that may come up. Always consider increasing your sales and moving your inventory as quickly as you can.

About the Author

Caron Beesley is a small business owner, a writer, and marketing communications consultant. Caron works with the SBA.gov team to promote essential government resources that help entrepreneurs and small business owners start-up, grow and succeed. Follow Caron on Twitter: @caronbeesley

(Source: SBA.gov)